BitcoinWorld

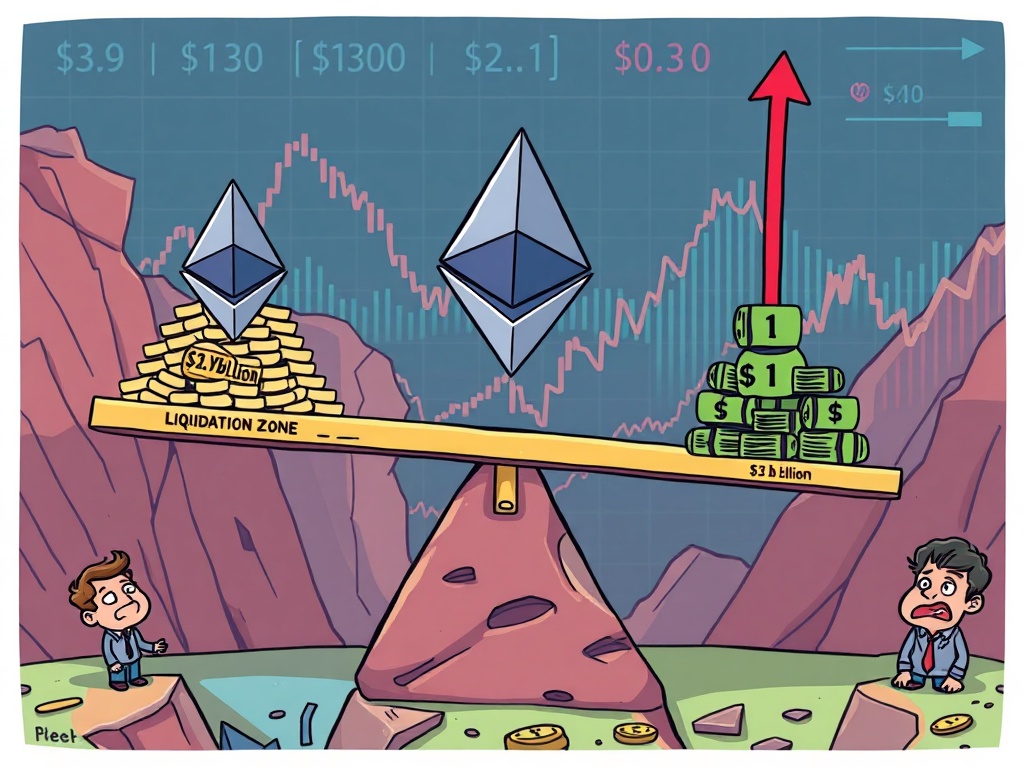

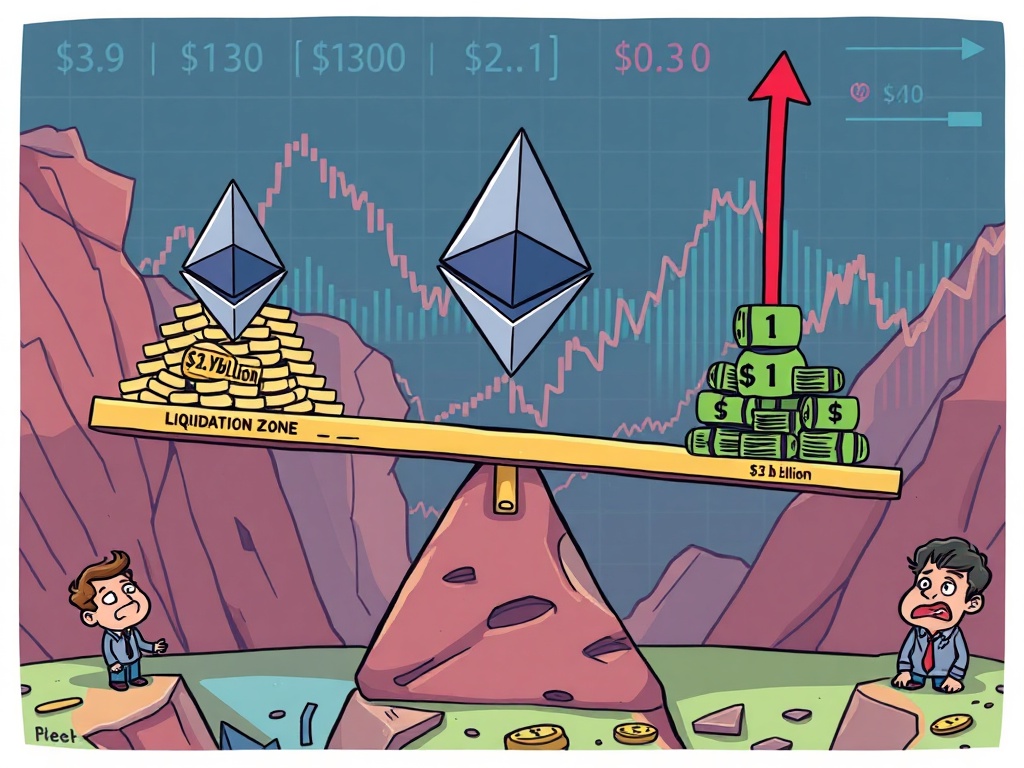

Ethereum Liquidations: A Crucial Warning for $2.9 Billion in ETH Longs

The cryptocurrency market is a dynamic arena, often swinging between exhilarating gains and nerve-wracking drops. Right now, a significant spotlight is on Ethereum (ETH), with a stark warning echoing through the trading floors: massive Ethereum liquidations could be on the horizon. This isn’t just market chatter; it’s a potential event that could see billions of dollars in leveraged positions wiped out, sending ripples across the entire crypto ecosystem.

According to recent data from CoinGlass, the stakes are incredibly high. Should Ethereum’s price dip below a critical threshold of $3,687, an astonishing $2.9 billion worth of ETH long positions are at risk of being liquidated across major centralized exchanges. Conversely, a surge above $4,062 could trigger the liquidation of approximately $1.31 billion in short positions. These figures aren’t mere statistics; they represent real capital, real traders, and a potential seismic shift in market sentiment. Understanding these thresholds and the mechanics behind them is crucial for anyone navigating the volatile waters of digital assets, especially when considering the impact of large-scale Ethereum liquidations.

What Exactly Are Ethereum Liquidations and Why Do They Matter So Much?

To truly grasp the gravity of the current situation, it’s essential to understand what ‘liquidation’ means in the context of cryptocurrency trading. Simply put, a liquidation occurs when an exchange forcefully closes a trader’s leveraged position due to a significant loss of initial margin. This happens when the market moves against a trader’s bet to a point where their collateral is no longer sufficient to cover potential losses.

Here’s a breakdown of why Ethereum liquidations are a big deal:

- Leverage Amplifies Risk: Traders use leverage to amplify their potential returns by borrowing funds to open larger positions than their initial capital allows. While this can magnify profits, it also dramatically increases the risk of loss.

- Margin Calls and Forced Closure: When the price moves unfavorably, the exchange issues a ‘margin call,’ requiring the trader to deposit more funds. If they fail to do so, or if the price continues to move rapidly, the position is automatically closed, leading to liquidation.

- Market Impact: Large-scale liquidations can create a cascading effect. As positions are forcibly closed, the underlying assets (like ETH) are often sold off, adding selling pressure to the market and potentially driving prices down further, which in turn triggers more liquidations. This feedback loop can lead to sharp, sudden price drops.

The Perilous Price Points: Unpacking ETH’s Critical Ethereum Liquidation Thresholds

The CoinGlass data provides specific price points that act as tripwires for these massive liquidations. These levels are not arbitrary; they represent the average liquidation prices for significant clusters of leveraged positions.

Let’s look at the two critical thresholds for potential Ethereum liquidations:

| Position Type | Trigger Price | Value at Risk | Market Impact |

|---|---|---|---|

| Long Positions | Below $3,687 | ~$2.9 Billion | Increased selling pressure, potential for sharp drop, cascading Ethereum liquidations. |

| Short Positions | Above $4,062 | ~$1.31 Billion | Increased buying pressure, potential for sharp rise, short squeeze. |

These figures highlight the sheer volume of capital poised at these crucial junctures. For long positions, the $3,687 mark represents a critical support level where a break could unleash a wave of forced selling. For short positions, $4,062 acts as a resistance point, where a breakout could trap bears and force them to cover their positions, fueling a rapid price ascent.

The Ripple Effect: How Massive Ethereum Liquidations Can Impact the Broader Market

The impact of large-scale Ethereum liquidations extends far beyond just the individual traders involved. When billions of dollars in positions are suddenly closed, it creates significant market volatility and can influence investor behavior across the entire crypto landscape.

- Enhanced Volatility: Liquidations often lead to rapid price movements. As selling pressure mounts from forced closures, prices can plummet quickly. Conversely, a short squeeze (triggered by short liquidations) can cause prices to skyrocket.

- Contagion Risk: While ETH is the primary asset at risk here, a significant downturn or surge in Ethereum’s price can affect other altcoins, especially those with strong correlations or projects built on the Ethereum blockchain.

- Sentiment Shift: Large liquidation events can damage market confidence, leading to fear and uncertainty. Traders might become more cautious, reducing overall trading volume and potentially slowing down market recovery.

- Opportunities for Savvy Traders: For those prepared and with strong risk management, these volatile periods can also present opportunities. Buying into panic selling or strategically shorting during a rapid ascent can be profitable, though extremely risky.

Navigating the Volatile ETH Market: Actionable Insights to Mitigate Ethereum Liquidations

Understanding the risks is the first step; taking proactive measures is the next. For both seasoned traders and new entrants, here are some actionable insights to help navigate potential Ethereum liquidations:

- Practice Prudent Risk Management: Always use stop-loss orders to limit potential losses. Never risk more capital than you can afford to lose. For leveraged positions, this is paramount.

- Avoid Excessive Leverage: While tempting, high leverage amplifies both gains and losses. Consider using lower leverage, or even avoiding it altogether, especially during periods of high market uncertainty.

- Monitor Liquidation Heatmaps: Tools like CoinGlass provide real-time data on liquidation levels. Paying attention to these ‘liquidation heatmaps’ can give you an edge in understanding where the market’s pressure points lie.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying across different cryptocurrencies and asset classes can help mitigate the impact of a significant price swing in any single asset.

- Stay Informed: Keep abreast of market news, technical analysis, and on-chain data. Understanding the broader market sentiment and fundamental developments can help you make more informed decisions and anticipate potential Ethereum liquidations.

- Consider Spot Trading: If the volatility of leveraged trading is too high, consider sticking to spot trading, where you own the underlying asset directly and are not at risk of liquidation due to price fluctuations.

Past Precedents and What This Means for the Future of Ethereum Liquidations

The crypto market has seen numerous large liquidation events in the past, often coinciding with significant price corrections or unexpected market shifts. These events, while painful for many, are a natural, albeit brutal, part of a highly leveraged market. They serve as a stark reminder of the inherent risks involved in margin trading.

Looking ahead, the potential for these Ethereum liquidations underscores the importance of market structure and liquidity. Should either of these critical price points be breached, the market will likely experience heightened volatility. However, it also presents an opportunity for the market to ‘reset’ by flushing out over-leveraged positions, potentially paving the way for more sustainable growth in the long run. The resilience of Ethereum’s ecosystem and its continued development will be key factors in how it navigates these challenging market dynamics.

In conclusion, the looming threat of significant Ethereum liquidations at the $3,687 and $4,062 marks is a critical indicator for all market participants. It highlights the inherent risks of leveraged trading and the potential for cascading effects on market volatility. By understanding these thresholds, practicing diligent risk management, and staying informed, traders can better position themselves to navigate these turbulent waters. The crypto market is always evolving, and vigilance remains the best strategy for safeguarding your investments against sudden shifts and massive liquidation events.

Frequently Asked Questions (FAQs) About Ethereum Liquidations

Q1: What is a crypto liquidation?

A: A crypto liquidation is the forced closure of a trader’s leveraged position by an exchange due to insufficient margin to cover potential losses. It occurs when the market moves significantly against the trader’s bet, and their collateral is no longer adequate.

Q2: How can I avoid Ethereum liquidations when trading with leverage?

A: To avoid Ethereum liquidations, practice robust risk management: use stop-loss orders, avoid excessive leverage, maintain sufficient margin, and monitor market conditions closely. Consider reducing position sizes during high volatility.

Q3: What typically happens after a large liquidation event in the crypto market?

A: After a large liquidation event, markets often experience increased volatility, sharp price movements, and a potential temporary dip in investor confidence. However, such events can also ‘cleanse’ the market of over-leveraged positions, potentially leading to a more stable environment in the long term.

Q4: Are all types of crypto trading subject to liquidation?

A: No, only leveraged or margin trading positions are subject to liquidation. If you hold cryptocurrencies in a spot wallet (meaning you own the assets outright without borrowing funds), you are not at risk of liquidation, though your asset’s value can still fluctuate.

Q5: Why is $3,687 a critical price for Ethereum liquidations?

A: According to CoinGlass data, $3,687 represents a significant cluster of average liquidation prices for long positions. If ETH drops below this level, it triggers a cascade of forced selling for these leveraged traders, potentially exacerbating the price decline.

Q6: How do platforms like CoinGlass track potential Ethereum liquidations?

A: Platforms like CoinGlass aggregate data from major centralized exchanges regarding open interest, funding rates, and estimated liquidation prices for leveraged positions. They use this data to identify clusters of positions that would be liquidated at specific price points, providing ‘liquidation heatmaps’ to traders.

If you found this article insightful, please consider sharing it with your network on social media! Your support helps us continue providing valuable insights into the dynamic world of cryptocurrency.

To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum price action.

This post Ethereum Liquidations: A Crucial Warning for $2.9 Billion in ETH Longs first appeared on BitcoinWorld and is written by Editorial Team