BitcoinWorld

Urgent: Iran Nuclear Claims Spark Global Stability Concerns, What It Means for Crypto Markets

In the fast-paced world of digital assets, understanding global events is paramount. Recent claims from Iran’s Foreign Ministry spokesperson, amplified by @solidintel_x on X, suggest that US airstrikes have caused significant damage to Iran Nuclear facilities. This startling development sends immediate ripples through international relations and, inevitably, prompts questions about its potential Crypto Market Impact. For cryptocurrency enthusiasts and investors, such geopolitical tremors often translate into market volatility, making it crucial to grasp the broader implications.

What’s Happening with Iran Nuclear Facilities?

The core of the recent news revolves around Iran’s assertion of damage to its nuclear infrastructure. According to the spokesperson, these facilities, which are central to Iran’s controversial nuclear program, have sustained substantial harm from recent US Airstrikes. While the specific nature and extent of the damage remain unverified by independent sources, the claim itself carries significant weight, given the long history of tension surrounding Iran’s nuclear ambitions.

- The Claim: Iran’s Foreign Ministry states US airstrikes heavily damaged nuclear sites.

- The Source: The claim was initially reported via @solidintel_x on X, citing an Iranian spokesperson.

- Verification Challenges: Independent confirmation of such claims is often difficult due to restricted access and the nature of military operations.

- Historical Context: Iran’s nuclear program has been a flashpoint for decades, leading to international sanctions and ongoing diplomatic efforts.

Understanding this context is vital, as it frames the potential responses from international actors and financial markets alike. The immediate concern is escalation, but the ripple effects extend far beyond the immediate region.

How Do US Airstrikes and Geopolitics Intersect with Crypto?

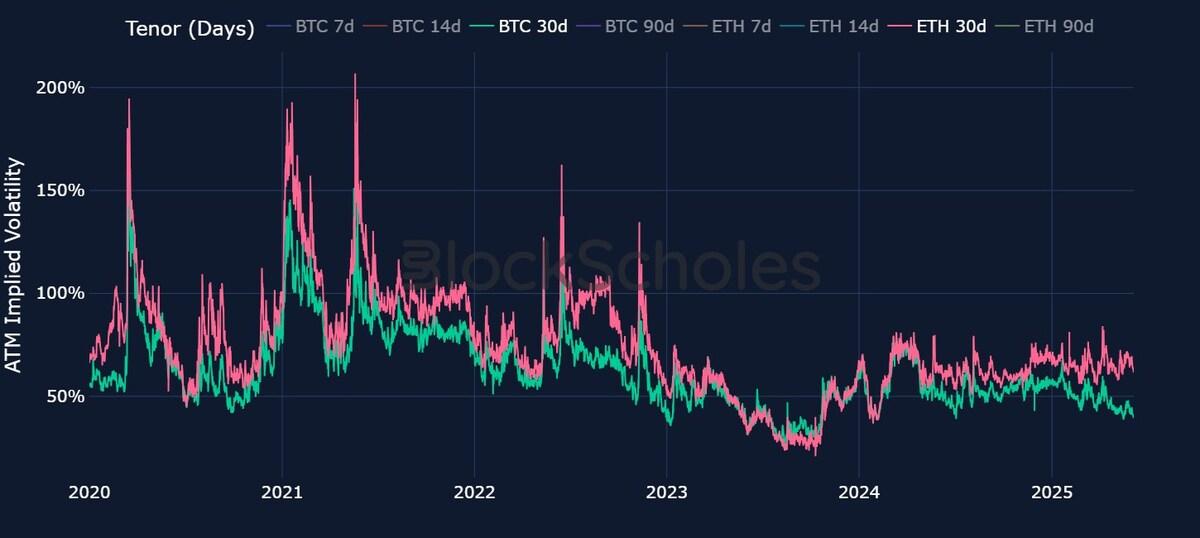

The relationship between geopolitical events, such as alleged US Airstrikes, and the cryptocurrency market might not be immediately obvious to everyone. However, history has shown a clear pattern: uncertainty breeds volatility, and in times of crisis, investors often seek perceived safe havens or, conversely, divest from riskier assets. Cryptocurrencies, particularly Bitcoin, have at times been touted as a digital gold, a hedge against traditional financial instability and geopolitical unrest.

When news of significant international incidents breaks, here’s how it can affect the crypto landscape:

- Increased Volatility: Fear, uncertainty, and doubt (FUD) can lead to rapid price swings across major cryptocurrencies and altcoins. Investors might panic sell or, conversely, ‘buy the dip.’

- Flight to Safety Narrative: Bitcoin’s role as a potential safe haven asset often gets tested during such times. If traditional markets (stocks, fiat currencies) show weakness, some investors might flock to Bitcoin, seeing its decentralized nature as a protective shield against state-controlled financial systems.

- Correlation with Traditional Markets: While crypto strives for independence, it often remains correlated with broader market sentiment. A downturn in global stocks due to heightened Geopolitical Tensions can pull crypto prices down with it.

- Sanctions and Digital Assets: In scenarios involving international sanctions, cryptocurrencies can become a tool for circumventing traditional financial systems, though this carries significant regulatory risks and is often a topic of intense debate.

This dynamic interplay highlights why staying informed about global affairs is not just for political analysts but for every savvy crypto investor.

Navigating Heightened Geopolitical Tensions: What’s the Impact?

The alleged damage to Iran’s nuclear sites, if confirmed, marks a significant escalation in Geopolitical Tensions. Such developments have far-reaching implications, extending beyond the immediate conflict zone to affect global energy markets, diplomatic relations, and, critically, investor confidence worldwide. The core challenge for investors is discerning short-term noise from long-term trends.

Potential Broader Impacts:

| Area of Impact | Description | Potential Consequence |

|---|---|---|

| Oil Markets | Iran is a major oil producer; regional instability can disrupt supply. | Spike in oil prices, impacting global economies and inflation. |

| Diplomacy | Further complicates nuclear negotiations and international relations. | Increased isolation for Iran, heightened risk of proxy conflicts. |

| Security | Raises concerns about regional stability and potential for wider conflict. | Increased military readiness, impact on trade routes. |

| Financial Markets | Investors become risk-averse, moving away from volatile assets. | Stock market dips, bond market shifts, potential for currency fluctuations. |

For the crypto space, this means that even if Bitcoin holds its ground initially, broader economic downturns driven by energy shocks or reduced investor confidence can still exert downward pressure on the entire market. The interconnectedness of global finance means few assets truly operate in a vacuum.

Understanding the Broader Global Stability Equation

The incident in Iran underscores how delicate Global Stability truly is. Every major geopolitical event has the potential to trigger a cascade of reactions across borders and markets. For the crypto world, this means that while decentralization offers a promise of independence, the market is still deeply intertwined with human psychology and global economic conditions. A perceived threat to stability can lead to widespread risk aversion, affecting even the most resilient digital assets.

Consider these aspects of global stability and their crypto relevance:

- Supply Chain Disruptions: Conflicts can disrupt trade, leading to inflation and economic slowdowns, which in turn affect discretionary spending and investment in assets like crypto.

- Currency Devaluations: In countries facing severe economic stress or sanctions, local populations might turn to cryptocurrencies as a way to preserve wealth, leading to localized surges in adoption.

- Regulatory Responses: Governments might react to global instability by increasing scrutiny on crypto, potentially leading to new regulations or restrictions.

- Investor Sentiment: Fear about the future of the global economy can lead to a general withdrawal from speculative assets, regardless of their individual merits.

Therefore, tracking major geopolitical flashpoints isn’t just about current affairs; it’s about anticipating shifts in the global economic landscape that will inevitably touch the crypto market.

Analyzing the Crypto Market Impact: What Comes Next?

The immediate Crypto Market Impact of the Iran nuclear claims and alleged US airstrikes is likely to be characterized by uncertainty. Investors should brace for potential volatility and consider their risk exposure. While Bitcoin often sees a surge in ‘safe haven’ narratives during such times, its correlation with traditional markets has also been evident, meaning a broader economic downturn could still pull it lower.

Actionable Insights for Crypto Holders:

- Stay Informed, Not Panicked: Differentiate between verified news and speculation. Rely on reputable sources and avoid making impulsive decisions based on unconfirmed reports.

- Review Your Portfolio: Assess your risk tolerance. Do you have a diversified portfolio? Consider if your current holdings align with your comfort level during periods of high uncertainty.

- Dollar-Cost Averaging: For long-term investors, continuing a dollar-cost averaging strategy can help mitigate the effects of volatility, allowing you to buy at different price points over time.

- Consider Stablecoins: If you’re highly risk-averse during turbulent times, temporarily moving a portion of your portfolio into stablecoins can offer a refuge from market swings, though they carry their own set of risks.

- Focus on Fundamentals: Volatility often shakes out weaker projects. Focus on cryptocurrencies with strong fundamentals, active development, and clear use cases.

Ultimately, the crypto market’s response will be a complex interplay of investor sentiment, macro-economic factors, and the specific developments in the geopolitical arena. Being prepared and informed is your best defense.

A Compelling Summary: Navigating the New Geopolitical Crypto Landscape

The claims regarding significant damage to Iran Nuclear facilities from alleged US Airstrikes introduce a fresh layer of complexity to an already intricate global landscape. These heightened Geopolitical Tensions are not isolated events; they send reverberations across all financial markets, including the dynamic world of cryptocurrencies. Understanding the potential for widespread Crypto Market Impact is crucial for investors aiming to navigate these turbulent waters.

While the immediate future may bring increased volatility and uncertainty, this situation also highlights the evolving role of digital assets in an interconnected world. Whether Bitcoin truly acts as a reliable safe haven or simply follows broader economic trends remains a subject of ongoing debate, but its unique characteristics make it a focal point during times of crisis. As the world grapples with maintaining Global Stability, staying informed, exercising caution, and applying sound investment principles will be paramount for anyone participating in the crypto space. The coming days and weeks will be critical in determining the true extent of the damage, both to the facilities and to the delicate balance of international relations, and consequently, its lasting effect on our digital financial future.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin’s price action amidst global events.

This post Urgent: Iran Nuclear Claims Spark Global Stability Concerns, What It Means for Crypto Markets first appeared on BitcoinWorld and is written by Editorial Team