More than $3 billion worth of Bitcoin and Ethereum options are set to expire today, potentially triggering big moves in the crypto market.

What’s Happening?

According to Deribit, around $2.65 billion in Bitcoin options are expiring. The “maximum pain” price — where most option holders lose money — is $94,000, which is well below Bitcoin’s current price of $102,570. That could mean some downward pressure on the price.

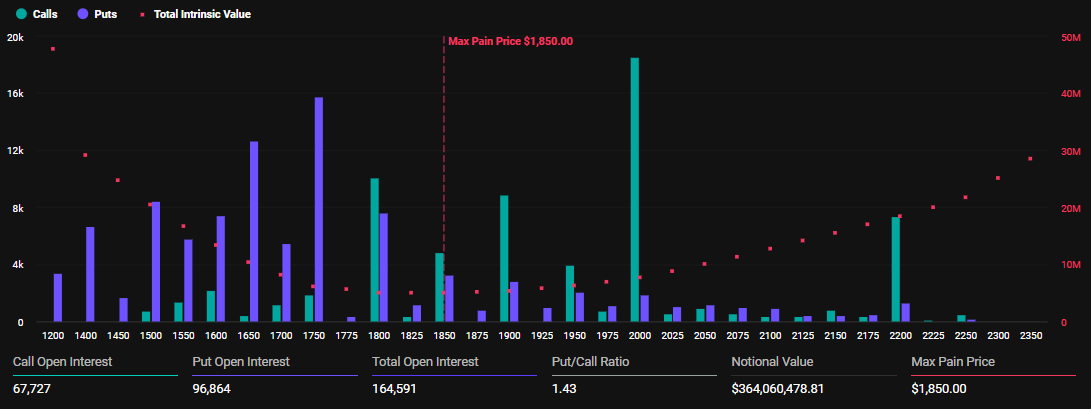

Ethereum isn’t far behind. Over 164,000 ETH contracts worth $364 million are also expiring, with a max pain point at $1,850. For both Bitcoin and Ethereum, more traders are betting on prices falling than rising — shown by put-to-call ratios above 1 (1.05 for BTC and 1.43 for ETH).

What Does It Mean?

The high number of bearish positions suggests traders expect short-term dips. Analysts at Greeks.live say the market feels like “boring chop,” with people positioning to profit from price stagnation or minor drops.

And with so many option contracts clustered below current BTC levels — especially between $93K and $99K — the market might gravitate toward those prices as expiration plays out.

What Else Could Impact Prices?

On top of the technicals, there’s geopolitical tension. US and Chinese officials are meeting in Switzerland this weekend for their first formal trade talks in a while. But neither side is showing signs of compromise.

If talks go poorly, it could shake markets — including crypto. On the flip side, any surprising good news could give Bitcoin a fresh boost, just like it did during Trump’s earlier trade deal announcements.

The post Over $3B in Bitcoin and Ethereum Options Expire Today — What It Means for the Market appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.