On Good Friday, April 18, a huge wave of crypto contracts—worth more than $2.2 billion—expired. These are Bitcoin and Ethereum options contracts, which are basically bets traders make on whether prices will go up or down.

This big expiry comes at a time when the crypto market is dealing with a lot of uncertainty, especially from the global economy. Former U.S. President Donald Trump is urging the Federal Reserve to cut interest rates, but the Fed Chair, Jerome Powell, isn’t moving. This back-and-forth is creating tension in the markets.

What’s Happening With Bitcoin and Ethereum?

Bitcoin (BTC):

- 23,221 BTC options contracts expired today

- Total value: $1.97 billion

- The “put-to-call ratio” is 0.96, meaning more traders are betting on the price going up (calls) than down (puts)

- The “max pain” price is $82,000 – this is the price where the most traders lose money

Ethereum (ETH):

- 177,130 ETH options contracts expired

- Total value: $280 million

- Put-to-call ratio: 0.84

- Max pain price: $1,600

These numbers show that traders are still leaning bullish (they think prices will go up), but only slightly.

Why Does This Matter?

When big options contracts expire, it can cause sudden price moves, especially if a lot of traders are caught on the wrong side. This is because many will have to either sell or buy quickly to cover their positions.

Last week, for example, $2.5 billion worth of BTC and ETH contracts expired, which caused short-term price dips. So, this isn’t new—it happens regularly, and it’s something traders keep a close eye on.

Even though today’s event is slightly smaller, it’s still big enough to shake things up.

Is a “Black Swan” Event Coming?

A “black swan event” is something totally unexpected that has a big impact on the markets—like the COVID-19 crash or FTX collapse.

Greeks.live analysts warn that the chances of such an event happening are higher right now because:

- The market feels tired and sentiment is weak

- The Fed isn’t cutting rates as fast as many hoped

- Trade tensions and global uncertainties are building again

They recommend that traders consider buying “out-of-the-money” put options. These are cheaper bets that make money if prices fall sharply—kind of like buying insurance for your portfolio.

What Are Experts Saying?

According to analysts at Deribit, a major crypto options exchange, the market looks calm right now. But history shows that after big expiry events like this, prices can swing sharply.

They asked:

“With volatility crushed and markets flat, is the market setting up for a big move?”

On top of that, analysts at Greeks.live, another trading platform, say traders are mostly bearish or neutral—meaning they don’t expect a big rally anytime soon.

They think Bitcoin might revisit the $80K to $82K range in the short term, which lines up with the max pain price.

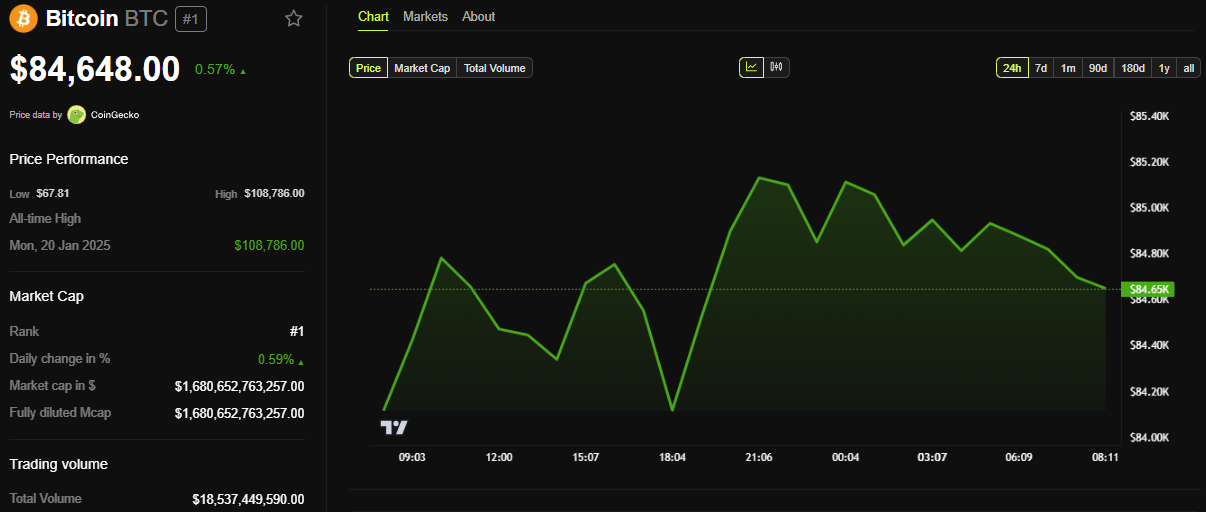

As of now, Bitcoin is trading around $84,648, slightly above that level.

The post Over $2.2 Billion in Bitcoin and Ethereum Options Expire on Good Friday — Could a Market Shakeup Be Coming? appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.