A big event is happening in the crypto market today. Around $2.58 billion worth of Bitcoin and Ethereum options are about to expire. This could lead to quick price changes and affect how traders make money.

Out of the total, Bitcoin (BTC) options are worth $2.18 billion, and Ethereum (ETH) options are worth $396 million.

Bitcoin and Ethereum May See Price Swings

Data from Deribit shows that 26,457 Bitcoin options will expire today. That’s much lower than the 139,260 BTC contracts that expired last week.

These options have a put-to-call ratio of 1.25. This means more traders expect the price to go down than up. The “max pain” price is $84,000. That’s the price where most options would lose value.

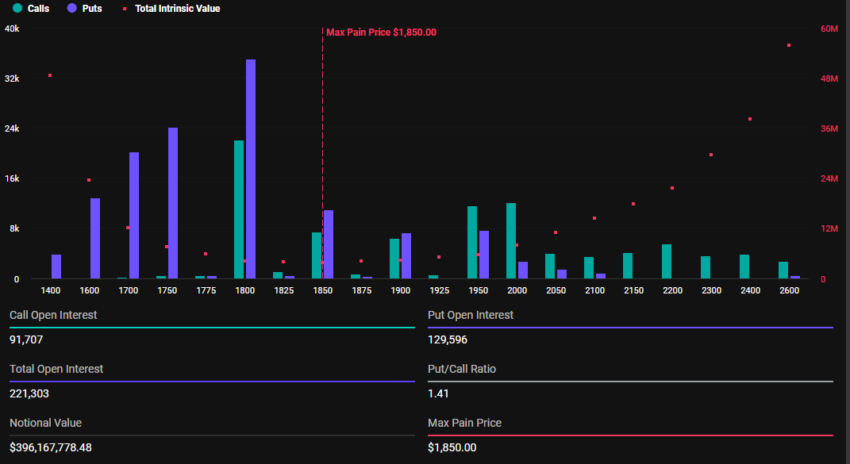

For Ethereum, 221,303 options are expiring today. This is also less than the 1 million that expired last week. The put-to-call ratio is 1.41, showing even more bearish feeling. The max pain price for ETH is $1,850.

What Is “Max Pain”?

“Max pain” is the price where most options expire with no value. Many big traders try to push the price near this level before options expire. This helps them lose less money or even profit.

Right now:

- Bitcoin is around $82,895

- Ethereum is at $1,790

This means prices might move closer to those pain points before 8:00 UTC, when the options expire.

What Happens After Expiry?

Once the options expire, prices may become more stable. But today’s big numbers could still cause price swings for a bit longer.

Even though BTC and ETH bounced back a little, the mood in the market is still nervous.

Why Are Traders Worried?

One reason for this worry is the recent news from the U.S. President Trump announced new import taxes — 10% on most goods and 25% on cars. Even though some people expected worse, it still made traders nervous.

Analysts at Greeks.live said many traders are now playing it safe. They noticed a lot of people buying “put” options (which profit when prices go down). One big move: 700 Bitcoin put options were bought with a strike price of $79,000, set to expire later this month.

This shows some traders think Bitcoin might go lower soon. The quick price jump to $88,000 earlier this week didn’t last. Prices dropped again soon after.

What’s Next?

Many traders are using careful strategies now, like shorting or using calendar trades. Most are avoiding risky bets. If Bitcoin ends today below $83,000, it could be a bad sign and cancel out recent gains.

There’s still a lot of worry about global trade and the economy. So, even after today’s expiry, don’t expect things to calm down right away.

The post Big Expiry Day: $2.6 Billion in Bitcoin and Ethereum Options Closing Today appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.