This week, some big events could shake up the crypto world. A new SEC chair might change crypto rules, Ethereum is rolling out a key upgrade, and there are rumors that AAVE is buying back its own tokens. Investors are keeping a close eye on these updates to see how they might affect crypto prices.

New SEC Chair Could Change Crypto Rules

A major event this week is the confirmation hearing for Paul Atkins, a nominee for SEC Chair, happening on March 27. Atkins is known for supporting fewer restrictions on crypto, which could be good news for the industry.

One Twitter user joked:

“Paul Atkins is stepping up to the SEC boss fight on March 27! Gensler’s crypto crackdown is ending faster than a rug pull.”

Atkins is expected to make regulations less strict, which could help crypto businesses grow more freely. If he’s approved, it might speed up the approval of Bitcoin and Ethereum ETFs, making it easier for big investors to put money into crypto.

However, his approval isn’t certain. If he doesn’t get the job, or if the decision takes too long, there might be more confusion about crypto rules.

Ethereum’s Pectra Upgrade is Almost Here

Ethereum’s Pectra upgrade is set to launch on a test network called Hoodi on March 26. If all goes well, it will be added to the main Ethereum network in April.

This upgrade is meant to make Ethereum faster and cheaper to use, especially for people who stake (lock up) ETH to earn rewards. A successful upgrade could make Ethereum more attractive to investors and developers.

However, past Ethereum updates have faced delays. For example, Ethereum’s big Merge upgrade was pushed back several times before it finally happened in September 2022. If Pectra runs into problems, it could cause Ethereum prices to drop or delay other projects.

Is AAVE Buying Back Tokens?

There are rumors that AAVE, one of the biggest DeFi projects, might buy back its own tokens by March 31. If true, this could reduce the number of AAVE tokens available, which might increase the price if demand stays strong.

A buyback usually means that the project’s team believes in its long-term value, which can boost investor confidence. But so far, there’s no official confirmation. If the rumors turn out to be false, the price could go up and down unpredictably.

Berachain’s New Staking System Launches

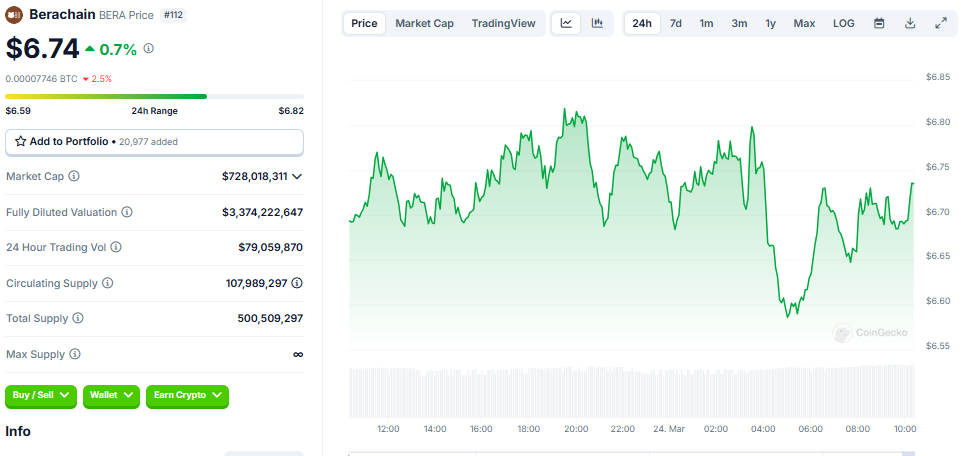

On March 24, Berachain introduced a new way of staking called Proof of Liquidity (PoL). Instead of regular staking, where users lock up tokens to earn rewards, this system lets decentralized apps (dApps) offer incentives to validators who help keep the network running.

This change could bring more investors and developers to Berachain. However, since Berachain is still a new blockchain, it’s unclear whether this system will be successful or risky.

At the moment, Berachain’s BERA token is priced at $6.74, barely changing in the last 24 hours. This suggests that investors are waiting to see what happens.

What’s Next?

This week could bring some big changes to the crypto market:

- If Paul Atkins becomes SEC Chair, crypto rules might become less strict, making it easier for businesses to grow.

- If Ethereum’s upgrade goes smoothly, it could strengthen Ethereum’s position in the market.

- If AAVE buyback rumors are true, it could push prices up.

Crypto is always unpredictable, but these events could shape the market’s future in the coming months. Stay tuned!

The post Big Crypto Events This Week: New SEC Chair, Ethereum Upgrade, and AAVE RumorsTop Crypto News This Week: Paul Atkins Confirmation, AAVE Buybacks, Pectra’s Hoodi Testnet, and More appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.