After Donald Trump’s recent announcement about creating a national crypto reserve, investor interest has surged in U.S.-based altcoins.

At the moment, the U.S. crypto reserve includes Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA). But according to experts, more coins could soon be added—Chainlink (LINK), Ondo (ONDO), and Litecoin (LTC) are among the top contenders.

Why Chainlink (LINK), Ondo (ONDO), and Litecoin (LTC) Could Be Next

Chainlink (LINK) – A Critical Piece of the Puzzle

Chainlink(LINK) is widely seen as a strong candidate because of its presence in the Coinbase 50 Index, its inclusion in Grayscale’s trust, and its connection to World Liberty Finance (WLFI)—a firm tied to Trump’s family.

According to Quinten, founder of WeRate, Chainlink’s technology is key to bringing real-world assets, such as gold and national reserves, onto the blockchain.

“Chainlink will be part of the Crypto Strategic Reserve. It will handle proof of reserves and help put major assets—gold, foreign currencies, and more—on-chain,” he predicted.

Ondo (ONDO) – A Close Tie to Trump’s Crypto Company

Ondo (ONDO) is also a strong contender, mainly because World Liberty Finance holds ONDO tokens. Plus, Donald Trump Jr., a co-founder of WLFI, has spoken at Ondo events—a clear sign of a strong connection.

“Trump has confirmed the national crypto reserve, and his own company, WLFI, holds Ondo. Trump Jr. and WLFI’s founders even spoke at the Ondo Summit. Ondo is a U.S.-based crypto, so it seems almost certain it will be included—or that Trump will use it to put the stock market on the blockchain,” predicted Investor Not Telling.

In response to Trump’s announcement, Ondo CEO Nathan Allman emphasized that Ondo is a U.S.-based blockchain company leading the charge in tokenizing U.S. Treasuries. He also revealed that the company plans to expand into stocks, bonds, and ETFs in the near future.

Litecoin (LTC) – A Strong Case for an ETF and National Reserve Spot

Litecoin (LTC) is another potential addition. Crypto analyst JRNY Crypto pointed out that Litecoin has a strong chance of getting a spot ETF, which would significantly increase its institutional adoption.

“All the coins mentioned so far are U.S.-based. They also said Bitcoin, Ethereum, and other coins could be included. In my opinion, Litecoin will be added to the reserve and get an ETF,” he stated.

According to Bloomberg analysts, there’s a 90% chance that a Litecoin ETF will be approved, making it one of the few cryptocurrencies on the verge of mainstream financial backing.

“Made in America” Crypto Boom

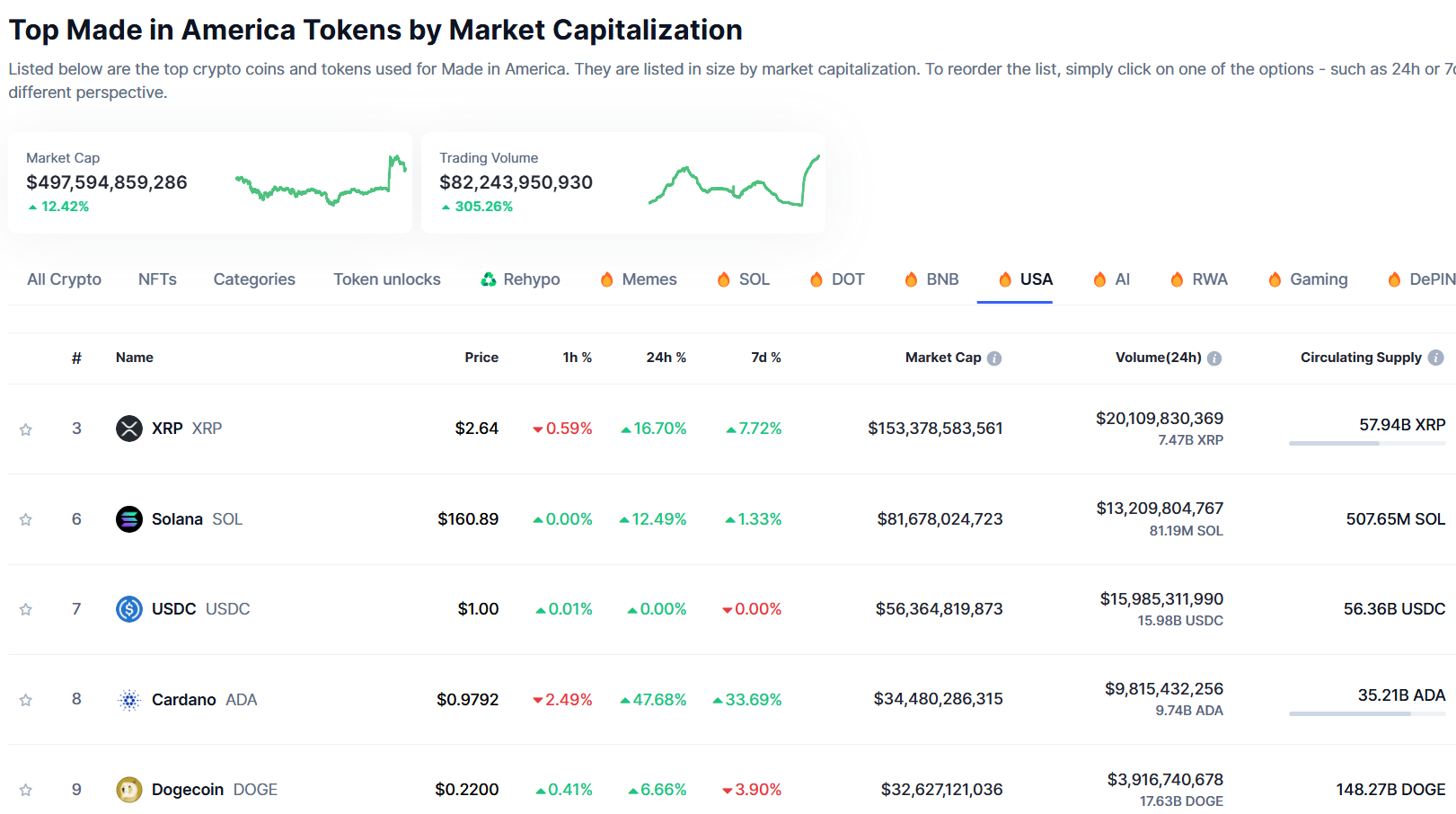

Following Trump’s announcement, U.S.-based altcoins surged in value, with their total market cap jumping 12% to nearly $500 billion, according to CoinMarketCap. This figure is 16 times larger than the total value of China-based cryptocurrencies, showing a growing preference for American projects.

Additionally, trading volume for these U.S. altcoins skyrocketed by 300% in just 24 hours, surpassing $82 billion, with XRP leading the charge.

Bitcoin Maximalists Push Back

Not everyone is on board with Trump’s plan to include altcoins in the U.S. crypto reserve. Many Bitcoin supporters argue that only Bitcoin (BTC) is stable and decentralized enough to be considered a true reserve asset.

This debate isn’t new. In recent years, El Salvador and the Central African Republic have made Bitcoin legal tender, while countries like China and Russia have explored digital assets to reduce their dependence on the U.S. dollar.

As the U.S. moves forward with its crypto reserve plan, the big question remains: Which altcoins will make the cut, and how will this reshape the future of crypto in America?

The post Experts Predict More Altcoins Could Be Added to US Crypto Reserve appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.