Ethereum made headlines earlier this month when the U.S. Securities and Exchange Commission (SEC) approved options trading for Ethereum spot exchange-traded funds (ETFs). This move is expected to bring more money into the market, attract institutional investors, and strengthen Ethereum’s position as a major cryptocurrency.

However, because Ethereum’s market is smaller than Bitcoin’s, it’s more sensitive to price swings, which means there are higher risks for investors. BeInCrypto spoke with experts and companies like FalconX, BingX, Komodo Platform, and Gravity to understand what this new development might mean for Ethereum.

Ethereum ETF Options Get SEC Approval

Ethereum enthusiasts celebrated when the SEC approved options trading for Ethereum ETFs earlier this month. This approval is an important step in bringing digital assets into the mainstream investment world.

This week marked the official start of options trading for Ethereum ETFs in the U.S. BlackRock’s iShares Ethereum Trust (ETHA) was the first to offer options on the Nasdaq ISE, followed by other ETFs like the Grayscale Ethereum Trust (ETHE) and Bitwise Ethereum ETF (ETHW), which began trading on the Cboe BZX exchange.

Now, more investors can trade Ethereum without actually owning the cryptocurrency, making it easier for traditional investors to get involved.

A Boost for Ethereum’s Market Position

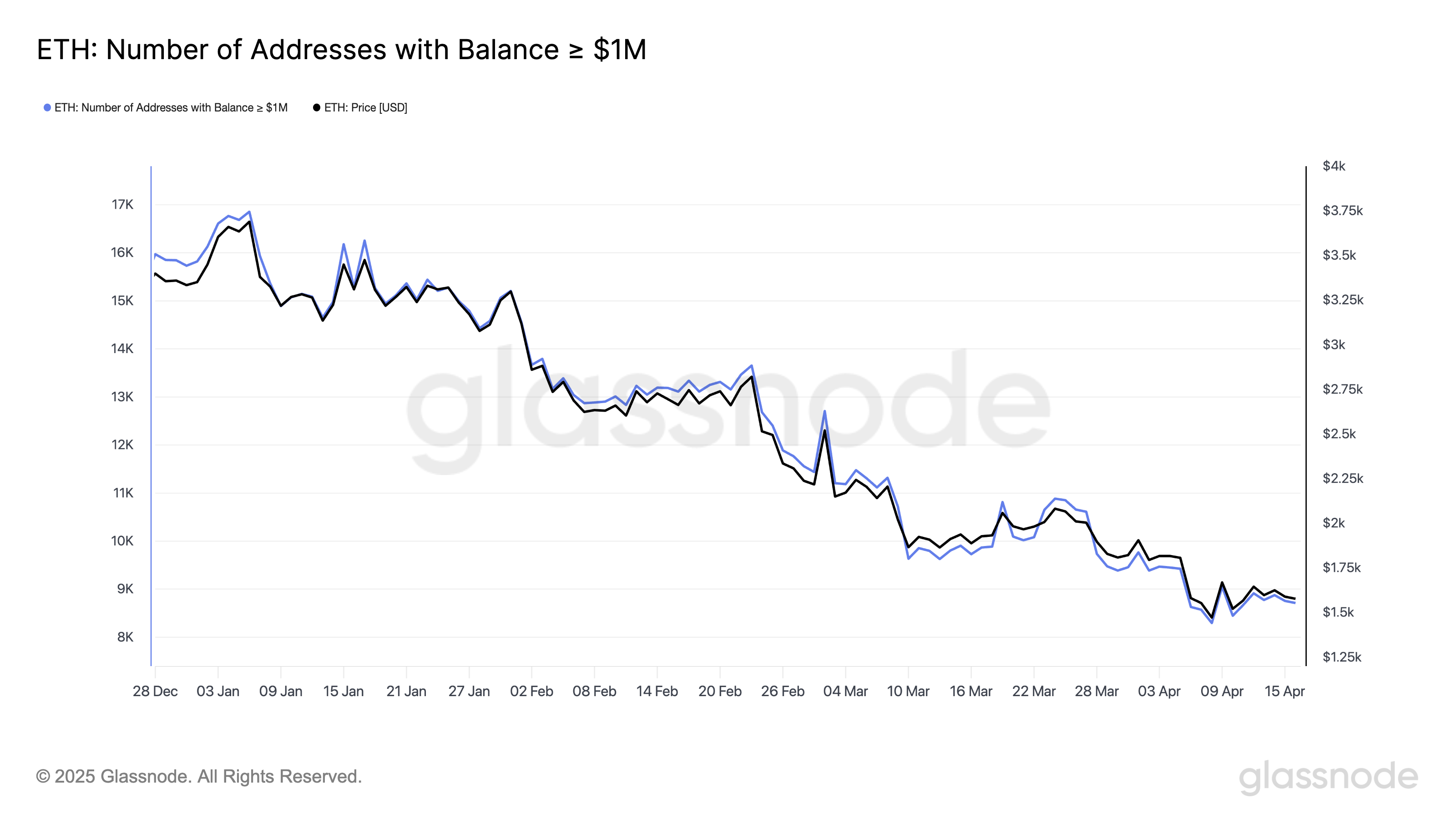

Despite some recent struggles, Ethereum is hoping this new development will help it regain strength in the market. Ethereum’s price recently dropped to its lowest level since March 2023, and Bitcoin’s market dominance is growing. However, experts believe the new options trading could help Ethereum.

“Ethereum has been losing market share, but options give it more institutional interest,” said Martins Benkitis, CEO and Co-Founder of Gravity Team. “The more tools available, the more capital will flow in.”

More Access and Liquidity for Investors

The SEC’s approval of Ethereum ETFs in 2024 made it easier for traditional investors to enter the market. With options trading now available, experts believe it will attract even more investors and bring more liquidity to Ethereum.

Vivien Lin, Chief Product Officer at BingX, said, “Options provide more ways for people to diversify their portfolios and participate in Ethereum-based products.” As more investors join in, the market will naturally become more liquid.

Higher Trading Volumes and Hedging

With options trading now available, trading volumes are expected to rise. This will likely lead institutional market makers to buy more Ethereum to meet the demand, which should help with liquidity.

However, the increase in options trading could also lead to price fluctuations in the short term. A situation known as a “gamma squeeze” could happen, where increased demand pushes prices up, creating a cycle as more investors jump in, hoping to profit.

The Risk of a Gamma Squeeze

Because Ethereum’s market is smaller than Bitcoin’s, it’s more prone to big price swings. If more investors buy options, it could lead to a gamma squeeze, where market makers are forced to buy more Ethereum to protect their positions. This could cause prices to rise quickly, drawing in even more retail investors.

Joshua Lim, Global Co-head of Markets at FalconX, pointed out, “Ethereum’s smaller market cap means it will be more vulnerable to a gamma squeeze compared to Bitcoin.”

Arbitrage and Price Differences

Some traders might take advantage of price differences between different markets, which is known as arbitrage. This could cause more price fluctuations, especially in the short term.

Can Ethereum Catch Up to Bitcoin?

While Ethereum’s new options trading is a big step forward, Bitcoin is still the dominant cryptocurrency. Some experts believe that even though Ethereum is growing, it’s unlikely to surpass Bitcoin anytime soon due to Bitcoin’s larger market cap and the fact that many investors still see it as a safer bet.

Kadan Stadelmann, CTO of Komodo Platform, said, “Bitcoin is still leading the market, and Ethereum has a much smaller market cap. To compete, Ethereum needs to grow in areas like decentralized finance (DeFi) and stablecoins.”

Conclusion

The SEC’s approval of options trading for Ethereum ETFs is a positive step for the cryptocurrency. It makes Ethereum more legitimate and brings in more institutional investors. While Ethereum still faces competition from Bitcoin, this move strengthens its position in the market and opens up more opportunities for investors. Whether this will help Ethereum close the gap with Bitcoin will depend on how investors react to this new trading option.

The post Ethereum ETF Options Launch Amid Market Challenges: A Potential Turning Point? appeared first on The Cryptoplay : All updates about Cryptocurrency worldwide.