BitcoinWorld

Trump Crypto Orders Unlocks New Era for Digital Asset Access

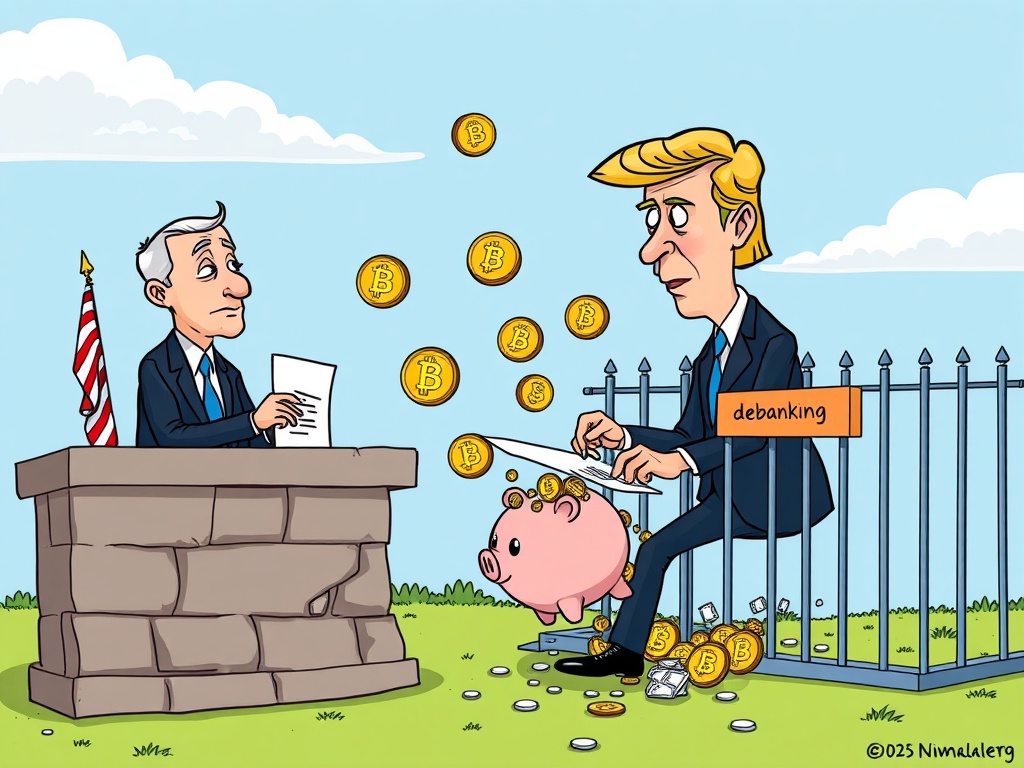

The cryptocurrency world is currently buzzing with significant news. Recent Trump crypto orders are poised to reshape how digital assets interact with traditional financial systems in the United States. These pivotal executive actions directly address long-standing concerns over crypto debanking and, importantly, open up new avenues for digital asset access within retirement portfolios. This strategic move signals a major acceleration towards broader institutional crypto adoption, potentially transforming the financial landscape.

Tackling Crypto Debanking: Why Is It a Game Changer?

For a considerable period, many legitimate businesses operating within the cryptocurrency sector faced a unique and frustrating challenge: securing essential banking services. This phenomenon, widely known as crypto debanking, involved traditional financial institutions denying accounts or closing existing ones for companies involved in digital assets, even when these businesses operated lawfully. This practice created significant hurdles for innovation, stifling growth and pushing some operations offshore.

President Trump’s first executive order aims directly at this issue. It seeks to prevent financial institutions from unjustly denying services to lawful businesses. This directive provides much-needed clarity and protection for crypto-related enterprises. Imagine a thriving tech startup unable to pay its employees or manage its finances simply because it deals with digital currencies. This order helps prevent such scenarios.

- Enhanced Stability: It brings greater stability and legitimacy to the crypto industry by ensuring fair access to essential financial services.

- Promotes Innovation: Businesses can now operate with more confidence, knowing their banking relationships are more secure, fostering further innovation.

- Wider Digital Asset Access: Ultimately, this measure paves the way for wider digital asset access for both businesses and consumers, integrating crypto more smoothly into the economy.

Unlocking Crypto Retirement: A New Frontier for Your Savings?

The second executive order is equally impactful, particularly for individual investors looking to diversify their long-term savings. Historically, including cryptocurrencies in traditional retirement vehicles like 401(k)s and pensions has been either restricted or fraught with regulatory uncertainty. This new order changes that, explicitly permitting the inclusion of cryptoassets in these vital retirement portfolios.

This is a groundbreaking development for anyone considering their financial future. It offers a fresh pathway for Americans to potentially grow their wealth by participating in the dynamic digital asset market. Think about the potential for crypto retirement options to become as common as traditional stock or bond allocations within your retirement plan.

- Investor Empowerment: Individuals gain more control and choice over their retirement investments, aligning with modern financial trends.

- Capital Influx: Allowing crypto in retirement funds could funnel substantial, long-term capital into the cryptocurrency market, providing significant liquidity and stability.

- Accelerated Institutional Crypto Adoption: This move is a clear signal that the government recognizes crypto as a legitimate asset class, accelerating the pace of institutional crypto adoption across the board.

The Broader Impact of Trump Crypto Orders: Paving the Way for Mainstream Acceptance

These two Trump crypto orders work in tandem, creating a more favorable environment for the entire digital asset ecosystem. By tackling the challenge of crypto debanking and simultaneously expanding options for crypto retirement, the path for greater institutional crypto adoption becomes significantly clearer. This isn’t just about individual access; it’s about the broader integration of digital assets into the global financial system.

What are the wider implications? We can anticipate increased engagement from traditional financial players – banks, asset managers, and pension funds – who previously hesitated due to regulatory ambiguity or perceived risks. As more institutions enter the space, liquidity will likely increase, and the market could mature further. While challenges remain, such as navigating market volatility and ongoing regulatory clarity, these orders provide a solid foundation.

The aim is to enhance overall digital asset access, making cryptocurrencies less of a niche investment and more of a mainstream component of diversified portfolios. This strategic push could lead to a future where digital assets are as commonplace as any other investment, benefiting a wide range of participants from retail investors to large financial institutions.

Conclusion: A Transformative Step Forward for Digital Assets

The recent executive orders signed by President Trump represent a truly transformative moment for the cryptocurrency industry. They directly address critical barriers to entry and growth, promoting fairness and opening exciting new investment avenues for everyday Americans. These actions could profoundly accelerate the integration of digital assets into the broader financial landscape, moving us closer to a future where cryptocurrencies are a recognized and integral part of global commerce and investment. This is an exciting time for anyone watching the evolution of finance.

Frequently Asked Questions (FAQs)

Q1: What is “crypto debanking” and how do the new orders address it?

A1: “Crypto debanking” refers to financial institutions denying services to lawful cryptocurrency businesses. The new executive order aims to prevent this, ensuring crypto companies have fair access to banking services, thereby fostering stability and growth.

Q2: Can I now put Bitcoin in my 401(k) or pension?

A2: Yes, the second executive order permits the inclusion of cryptoassets in retirement portfolios like 401(k)s and pensions. This opens up new investment opportunities for diversifying retirement savings.

Q3: How will these orders impact the overall cryptocurrency market?

A3: These orders are expected to significantly boost institutional crypto adoption and legitimacy. By reducing barriers and opening new investment avenues, they could lead to increased capital inflow, market maturity, and broader mainstream acceptance of digital assets.

Q4: Are there any risks associated with investing crypto in retirement accounts?

A4: While these orders create new opportunities, investing in crypto still carries risks, including market volatility and regulatory uncertainties. It is important for investors to conduct thorough research and consider their risk tolerance before allocating funds.

Q5: What does “institutional crypto adoption” mean in this context?

A5: Institutional crypto adoption refers to large financial entities like banks, asset managers, and pension funds actively engaging with and investing in cryptocurrencies. These executive orders remove some key hurdles, encouraging more such institutions to enter the digital asset space.

If you found this article insightful, please consider sharing it with your network! Help us spread the word about these crucial developments shaping the future of finance and digital asset access.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin institutional adoption.

This post Trump Crypto Orders Unlocks New Era for Digital Asset Access first appeared on BitcoinWorld and is written by Editorial Team