BitcoinWorld

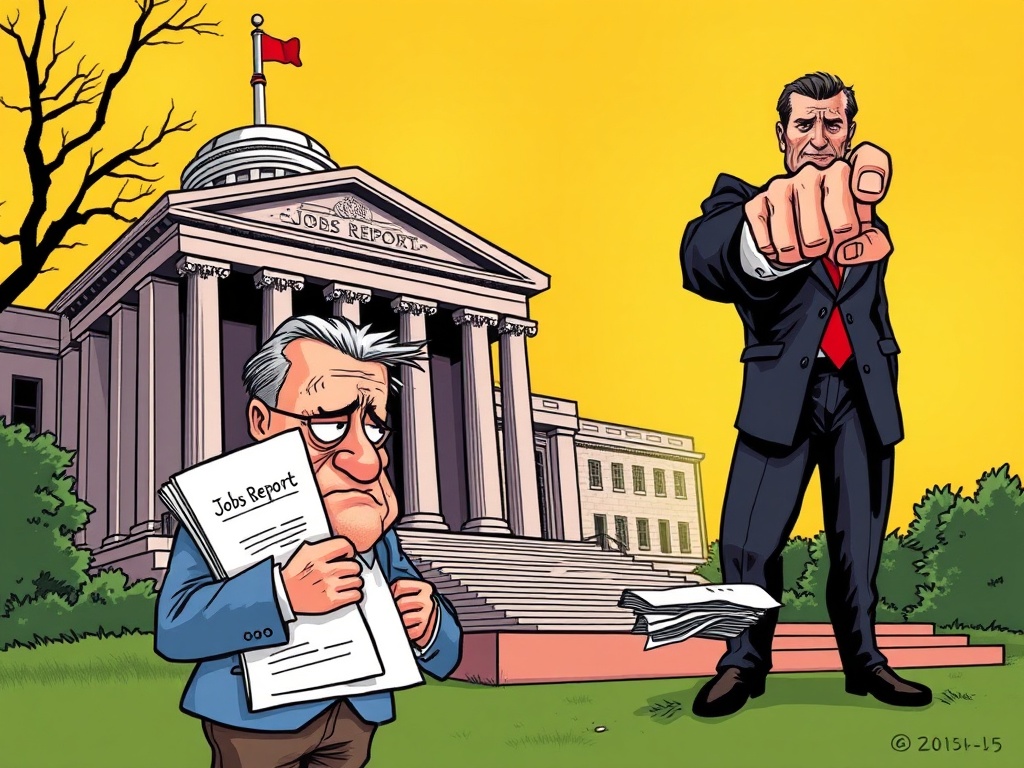

Economic Data Integrity: Trump’s Shocking Order Sparks Jobs Report Controversy

In the dynamic world of finance, from traditional stocks to the volatile realm of cryptocurrencies, one constant truth prevails: market confidence hinges significantly on the perceived reliability of official economic indicators. When the spotlight turns to the very foundation of these indicators – economic data integrity – it sends ripples across all sectors. Recently, a significant political development has ignited widespread discussion, raising questions about the accuracy and impartiality of crucial government statistics, particularly concerning jobs reports.

What’s the Latest on Economic Data Integrity?

The news, as reported by Whale Wire CEO Jacob King on X, points to a startling directive from former President Donald Trump. According to King, Trump has allegedly ordered the dismissal of Labor Commissioner Erika McEntarfer. The reason? A “shockingly low” jobs report that, crucially, saw a significant downward revision of job gains. This incident immediately thrusts the concept of economic data integrity into the forefront of national discourse.

The core of the controversy centers on two main points:

- The initial publication of a jobs report deemed “shockingly low” by Trump.

- A subsequent revision that reduced reported job gains by a substantial 258,000.

- Accusations from Trump that the Commissioner previously manipulated data to undermine his presidential campaign.

Such accusations, if substantiated, have profound implications not just for political narratives but for the fundamental trust in the institutions responsible for compiling and disseminating vital economic information.

The Jobs Report Controversy: Why Revisions Spark Debate

Jobs reports are among the most closely watched economic indicators, offering a snapshot of the labor market’s health. They influence everything from Federal Reserve interest rate decisions to investor sentiment. Revisions to these reports are not uncommon; initial estimates are often refined as more comprehensive data becomes available. However, the scale of this particular revision, coupled with the political context, has amplified concerns about economic data integrity.

Let’s consider the impact of such revisions:

| Aspect | Initial Report | Revised Report |

|---|---|---|

| Job Gains (Reported) | Higher Initial Estimate | 258,000 Lower |

| Market Perception | More Optimistic | Less Optimistic |

| Economic Outlook | Stronger Growth Indicated | Slower Growth Indicated |

While routine, a revision of this magnitude, especially when accompanied by accusations of political motivation, inevitably raises questions about the robustness of the initial data collection and analysis processes. This directly challenges public confidence in economic data integrity.

Accusations of Manipulation: A Threat to Trust in Economic Data Integrity?

Trump’s accusation goes beyond just the recent revision. He claims that Commissioner McEntarfer previously manipulated data specifically to damage his presidential campaign. This suggests a pattern of alleged misconduct, if true, that extends beyond a single report. Such claims, whether proven or not, can erode public trust in government institutions and the information they provide.

The implications of such accusations are far-reaching:

- Erosion of Public Trust: If citizens believe economic data is manipulated for political gain, it undermines faith in government transparency and accountability.

- Market Volatility: Uncertainty about the true state of the economy can lead to increased market volatility as investors struggle to make informed decisions.

- Policy Challenges: Policymakers rely on accurate data to formulate effective strategies. Doubts about data accuracy can lead to misguided economic policies.

- Impact on Investment Decisions: Businesses and individuals make investment choices based on economic outlooks. Compromised data makes these decisions riskier.

The ongoing debate highlights the critical importance of maintaining impeccable economic data integrity for a stable and predictable economic environment.

Why Does Economic Data Integrity Matter for Crypto Investors?

While this incident appears rooted in traditional politics and economics, its implications resonate within the cryptocurrency world. Crypto markets, despite their decentralized nature, are not immune to broader economic sentiment and global market trends. Here’s why economic data integrity is relevant:

- Investor Confidence: When confidence in traditional economic data wavers, it can lead to a flight to safety or, conversely, a search for alternative assets. Some investors might view cryptocurrencies as a hedge against perceived manipulation or instability in traditional systems.

- Monetary Policy Impact: Central banks use jobs reports and other economic data to guide monetary policy. If these reports are questioned, central bank decisions might be perceived as less reliable, potentially impacting inflation expectations and, by extension, the appeal of deflationary assets like Bitcoin.

- Market Narrative: A narrative of distrust in official statistics can fuel interest in decentralized, transparent systems, which is a core tenet of many cryptocurrencies.

- Capital Flows: Global capital flows are influenced by perceptions of economic stability and growth. If a major economy’s data is seen as unreliable, it could affect foreign investment and overall market liquidity, which can indirectly impact crypto valuations.

Ultimately, a healthy global economy, built on reliable data, provides a more stable backdrop for all asset classes, including the burgeoning digital asset space. Questions about economic data integrity introduce an element of uncertainty that no market welcomes.

Navigating Uncertainty: Actionable Insights for the Informed Investor

In an environment where the reliability of official economic data is being questioned, how can investors, particularly those in the crypto space, navigate the waters? Maintaining a clear perspective and making informed decisions is paramount.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. A diversified portfolio, including a mix of traditional and digital assets, can help mitigate risks associated with specific market shocks or data controversies.

- Stay Informed, Critically: Follow news from multiple reputable sources. Understand that initial reports can be revised and that political rhetoric often accompanies economic discussions. Distinguish between verified facts and accusations.

- Focus on Long-Term Trends: While short-term news cycles can create volatility, fundamental long-term trends in technology adoption, global economic shifts, and industry growth often provide a more reliable compass for investment decisions.

- Understand the Macro Landscape: Recognize that individual economic reports are part of a larger picture. Look at multiple indicators and global events to form a comprehensive view of the economy.

- Practice Due Diligence: For crypto investments, this means thoroughly researching projects, understanding their utility, and assessing their long-term viability, rather than reacting impulsively to every market tremor.

The incident surrounding the jobs report and the Labor Commissioner serves as a stark reminder of the continuous need for vigilance and a deep understanding of the forces shaping our financial world, reinforcing the need for economic data integrity.

The alleged directive from Donald Trump to dismiss Labor Commissioner Erika McEntarfer over a revised jobs report has undeniably sparked a significant debate about the transparency and reliability of government-issued economic statistics. While the full implications of these accusations are still unfolding, the incident underscores a fundamental principle: the bedrock of a stable economy and confident markets is unassailable economic data integrity. For investors across all asset classes, including the rapidly evolving cryptocurrency market, trust in the data that shapes policy and market sentiment is paramount. As this story develops, it will be crucial to observe how these claims are addressed and what measures, if any, are taken to reinforce public confidence in the accuracy of economic reporting.

Frequently Asked Questions (FAQs)

Q1: What is the main controversy regarding the Labor Commissioner?

A1: The controversy stems from former President Donald Trump’s alleged order to fire Labor Commissioner Erika McEntarfer following a “shockingly low” jobs report that was later revised downward by 258,000 jobs. Trump also accused her of manipulating data in the past to harm his presidential campaign.

Q2: Why are jobs reports so important for the economy?

A2: Jobs reports are crucial economic indicators that provide insights into the health of the labor market. They influence monetary policy decisions by central banks, affect investor confidence, and help businesses and individuals make financial plans. Their accuracy is vital for sound economic decision-making.

Q3: How does this incident relate to “economic data integrity”?

A3: This incident directly challenges “economic data integrity” by raising questions about the impartiality and accuracy of official government statistics. Accusations of data manipulation, whether proven or not, can erode public trust in the reliability of information used to gauge economic performance.

Q4: Can controversies over economic data affect cryptocurrency markets?

A4: Yes, indirectly. While crypto markets are decentralized, they are influenced by broader economic sentiment. Doubts about traditional economic data can impact investor confidence, lead to shifts in capital flows, and fuel narratives around decentralized alternatives, all of which can affect crypto valuations.

Q5: Are revisions to economic data reports common?

A5: Yes, revisions to economic data, including jobs reports, are common as more comprehensive information becomes available. However, the magnitude of a revision, especially when coupled with political accusations of manipulation, can draw significant scrutiny and raise concerns about the underlying data quality.

What are your thoughts on the importance of economic data integrity in today’s volatile markets? Share this article on your social media platforms to join the conversation and help others understand the potential implications of this significant development!

To learn more about the latest economic policy trends, explore our article on key developments shaping global markets and their future impact.

This post Economic Data Integrity: Trump’s Shocking Order Sparks Jobs Report Controversy first appeared on BitcoinWorld and is written by Editorial Team