BitcoinWorld

Bitcoin Futures: Unveiling the Staggering $1.85B Inflow and Market Implications

The cryptocurrency world is always buzzing with activity, and recent data from CryptoQuant has sent ripples across the market. A staggering alert highlighted a colossal inflow of over 16,000 Bitcoin, valued at approximately $1.85 billion, into various futures exchanges within a mere hour. This significant movement, particularly concerning Bitcoin futures, immediately caught the attention of analysts and investors alike, prompting crucial questions about its potential impact on market dynamics. What does such a massive transfer signify, and how might it influence the price trajectory of Bitcoin?

Understanding the Recent Bitcoin Futures Inflow: What Happened?

CryptoQuant, a well-respected on-chain analytics firm, issued a timely alert via its Telegram channel detailing an extraordinary event. Nearly 16,010 Bitcoin (BTC) were deposited into several major futures exchanges in a remarkably short period. Such large-scale movements are rarely coincidental and often precede significant market volatility or shifts in sentiment. The sheer volume of this Bitcoin futures inflow suggests a coordinated effort, potentially from institutional players, rather than individual retail investors.

Let’s break down where this massive influx of Bitcoin landed:

| Exchange | BTC Deposited | Approximate Percentage |

|---|---|---|

| Kraken | 15,748 BTC | 98% |

| Bitfinex | 84 BTC | 0.5% |

| OKX | 65 BTC | 0.4% |

| Total | 16,009.59 BTC | 100% |

As evident from the table, Kraken received the lion’s share, accounting for an overwhelming 98% of the total inflow. This concentration on a single exchange, especially one known for catering to institutional clients, is a critical piece of the puzzle when analyzing the implications for Bitcoin futures.

What Does This Bitcoin Futures Movement Signify?

The core question arising from this substantial inflow into Bitcoin futures exchanges is its meaning. Generally, large deposits of Bitcoin onto exchanges can be interpreted in several ways, but when specifically directed towards futures platforms, the implications often lean towards increased speculative activity. Here are some key interpretations:

- Increased Volatility Potential: When significant amounts of Bitcoin are moved to futures exchanges, it typically indicates that large players are preparing to open or close substantial positions. This can lead to heightened volatility as these positions are executed, potentially triggering rapid price swings in either direction.

- Institutional Interest and Positioning: CryptoQuant specifically highlighted that such large inflows to exchanges supporting custody could originate from institutional clients. Institutions often use futures markets for hedging existing spot positions, speculating on future price movements with leverage, or gaining exposure without direct ownership of the underlying asset. Their presence can bring both stability through hedging and increased volatility through large directional bets.

- Preparation for Major Market Moves: A sudden influx of Bitcoin into futures exchanges might suggest that these large entities anticipate a significant price movement. They could be positioning themselves to capitalize on an expected rally (by opening long positions) or to profit from a downturn (by opening short positions). This creates a sense of anticipation in the broader market.

- Liquidity Provision: While less common for such large, sudden movements, some institutions might be moving funds to provide liquidity for their trading operations, facilitating smoother execution of their strategies on the futures market.

Navigating the Waters: Challenges and Opportunities in Bitcoin Futures

For market participants, understanding these dynamics is crucial. The presence of significant institutional capital in Bitcoin futures markets presents both challenges and opportunities:

Challenges:

- Enhanced Price Swings: The potential for large, sudden price movements increases, making it more challenging for retail traders to predict short-term trends.

- Liquidation Risks: For those trading with leverage, increased volatility can lead to faster liquidations if positions move against them.

- Information Asymmetry: Institutional players often have access to more sophisticated analytical tools and resources, creating an information advantage.

Opportunities:

- Arbitrage Possibilities: Discrepancies between spot and futures prices can create arbitrage opportunities for savvy traders.

- Hedging Strategies: For Bitcoin holders, futures can be a valuable tool to hedge against potential price declines, protecting their portfolio value.

- Market Depth: Increased institutional participation can lead to deeper order books, potentially improving overall market efficiency for large trades.

It’s important to remember that futures markets are complex and carry inherent risks, especially due to the leverage involved. Understanding these risks is paramount for anyone considering participation.

Actionable Insights for Bitcoin Futures Participants

Given this significant Bitcoin futures inflow, what should investors and traders consider? Here are some actionable insights:

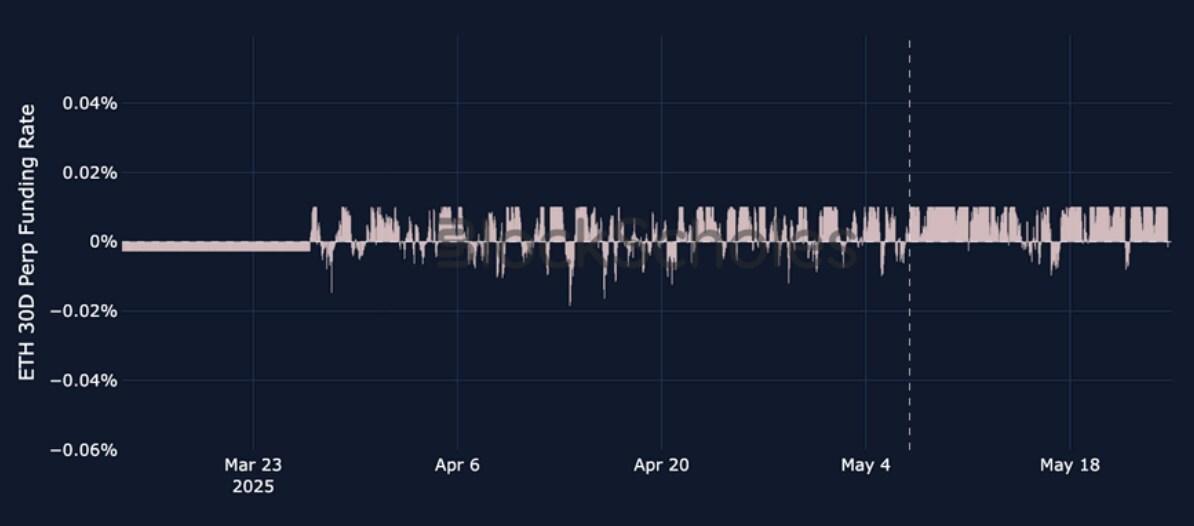

- Monitor Funding Rates: Keep a close eye on funding rates on futures exchanges. High positive funding rates suggest a bullish sentiment (more longs paying shorts), while negative rates indicate bearish sentiment (more shorts paying longs). A sudden shift could signal market direction.

- Observe Open Interest: Track the total number of outstanding futures contracts (open interest). A rise in open interest alongside price movement can confirm the strength of a trend. If open interest rises with price, it supports a bullish trend; if it rises while price falls, it supports a bearish trend.

- Exercise Caution with Leverage: While leverage can amplify gains, it equally amplifies losses. In periods of potential high volatility, reducing leverage or avoiding highly leveraged positions can mitigate risk.

- Stay Informed with On-Chain Data: Continue to follow alerts from firms like CryptoQuant. On-chain data provides valuable insights into large-scale movements that traditional market analysis might miss.

- Develop a Risk Management Strategy: Always have a clear entry and exit strategy, including stop-loss orders, to protect your capital from unexpected market swings.

The current environment underscores the importance of a well-informed and cautious approach to trading, especially in the volatile realm of Bitcoin futures.

Conclusion: The Enduring Impact of Bitcoin Futures Flows

The recent CryptoQuant alert detailing a massive $1.85 billion Bitcoin futures inflow serves as a powerful reminder of the dynamic and often unpredictable nature of the cryptocurrency market. This significant movement, predominantly to Kraken, strongly suggests that institutional players are actively positioning themselves, signaling potential for heightened volatility and shifts in market sentiment. While the exact intent behind such large deposits remains a subject of ongoing analysis, it undeniably highlights the growing influence of sophisticated investors in the Bitcoin ecosystem.

For traders and investors, staying abreast of these on-chain indicators and understanding their implications is more critical than ever. The world of Bitcoin futures continues to evolve, offering both substantial opportunities and considerable risks. A prudent approach, grounded in robust research and disciplined risk management, will be key to navigating the exciting yet challenging landscape ahead.

Frequently Asked Questions (FAQs)

Q1: What is a Bitcoin futures inflow?

A: A Bitcoin futures inflow refers to a significant amount of Bitcoin being deposited onto cryptocurrency exchanges that offer futures trading. These deposits typically indicate that large traders or institutions intend to open new leveraged positions or adjust existing ones on the futures market.

Q2: Why is a large Bitcoin futures inflow significant?

A: Large inflows are significant because they often precede increased market volatility. They suggest that major players are positioning themselves for anticipated price movements, either to go long (bet on price increase) or short (bet on price decrease), which can lead to rapid price swings.

Q3: Does this mean Bitcoin’s price will go up or down?

A: A large inflow itself doesn’t definitively predict price direction. It indicates an expectation of significant movement. Traders might be preparing for a rally (long positions) or a downturn (short positions). Further analysis of funding rates, open interest, and broader market sentiment is needed to infer direction.

Q4: What role do institutional clients play in Bitcoin futures?

A: Institutional clients use Bitcoin futures for various purposes, including hedging their existing spot Bitcoin holdings, speculating on future price movements with leverage, or gaining exposure to Bitcoin without direct ownership. Their large capital can significantly influence market depth and volatility.

Q5: How can I monitor Bitcoin futures activity?

A: You can monitor Bitcoin futures activity by following on-chain analytics firms like CryptoQuant, checking exchange data for open interest and funding rates, and observing news from reputable crypto market analysis platforms. These resources provide insights into large fund movements and market sentiment.

Q6: Is trading Bitcoin futures risky?

A: Yes, trading Bitcoin futures is inherently risky, primarily due to the use of leverage. While leverage can amplify profits, it can also magnify losses, potentially leading to rapid liquidation of positions if the market moves unfavorably. It requires a strong understanding of market dynamics and robust risk management.

If you found this analysis insightful, consider sharing it with your network! Understanding these crucial market signals helps everyone make more informed decisions in the dynamic world of cryptocurrency. Share this article on your social media platforms to help others stay ahead in the crypto game.

To learn more about the latest Bitcoin market trends, explore our article on key developments shaping Bitcoin institutional adoption.

This post Bitcoin Futures: Unveiling the Staggering $1.85B Inflow and Market Implications first appeared on BitcoinWorld and is written by Editorial Team